RiskAPI® Add-In

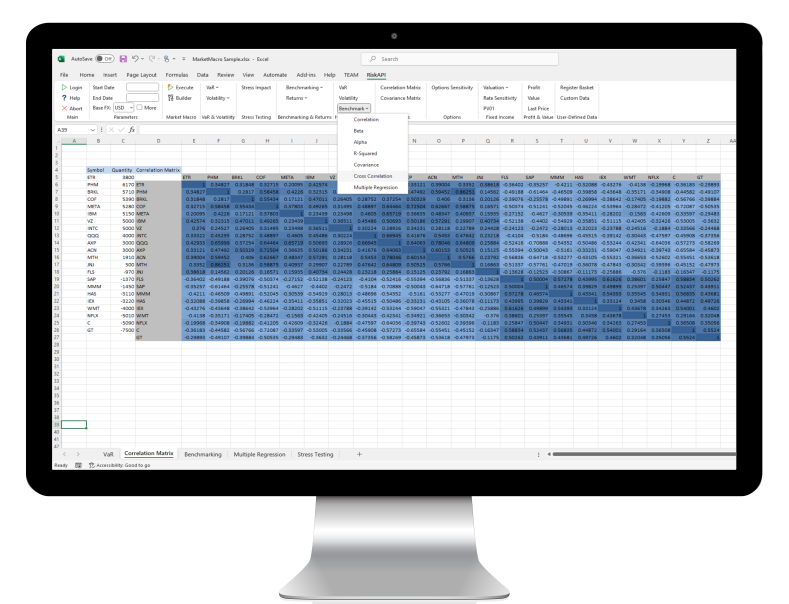

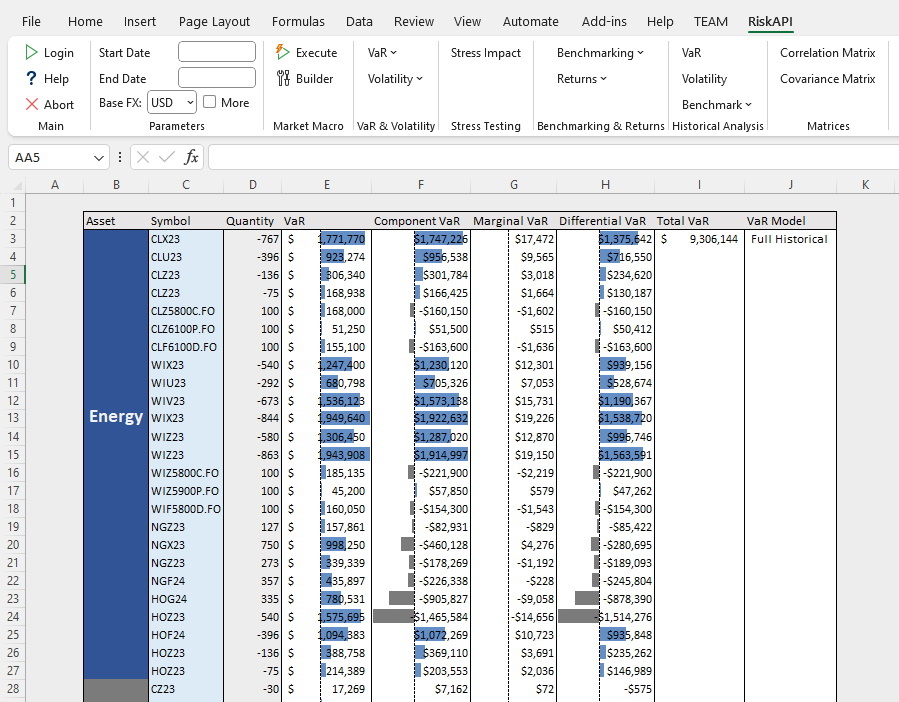

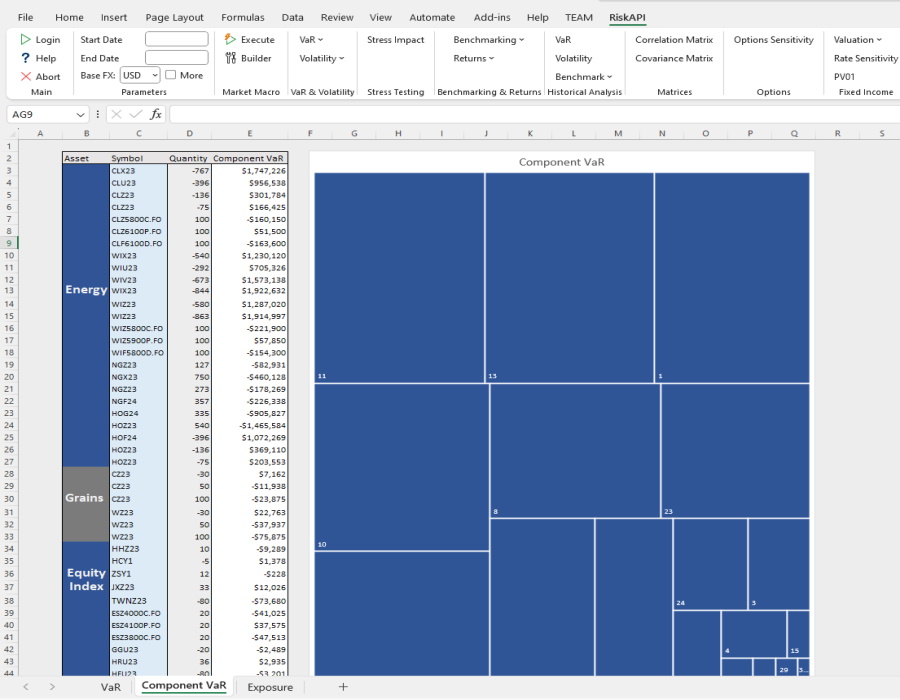

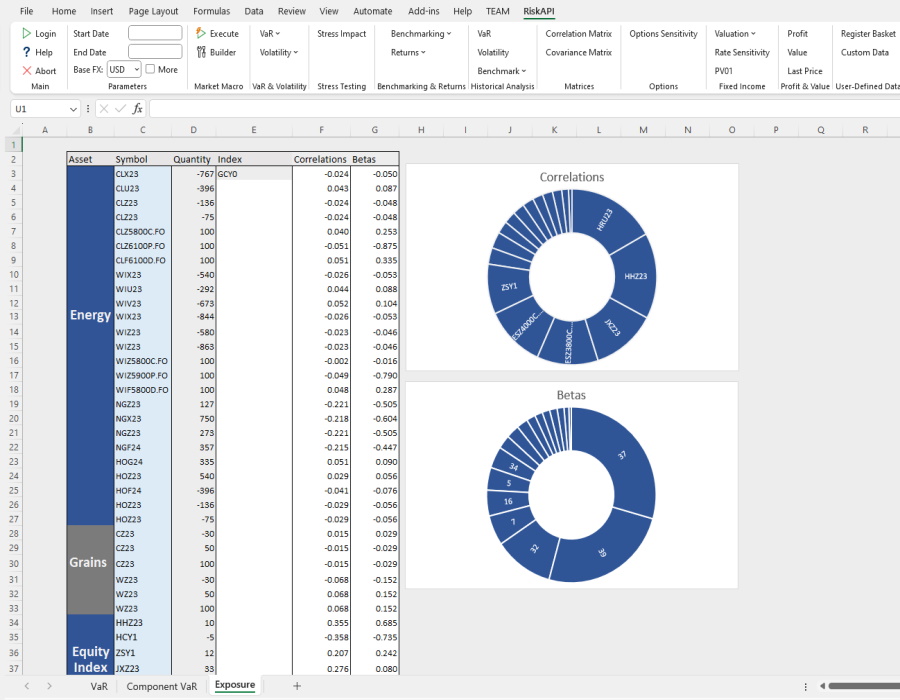

The RiskAPI Add-In connects Excel spreadsheets to a powerful, remote, data-driven risk engine, bringing dozens of quantitative portfolio risk calcuations seamlessly into Excel.

Generate on-demand VaR, Stress-testing, exposure analysis and more. Available via easily accessible menus, worksheet formulas, vb macros, and automated keywords.

The Add-In harnesses market data and computing power from the RiskAPI service, allowing users to quickly and easily produce portfolio risk calculation results with nothing but symbol and quantity inputs only.

Demo & Free Trial